capital gains tax proposal effective date

More than five months ago. This proposal would be effective for.

June 9 2021 Bernie Kent JD CPA PFS It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains.

. This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28. Taxpayers can consider triggering gain before the potential effective date of a capital gains change but should assess the outlook carefully and understand the risk. The effective date for the capital gains tax hike would be April 28 2021 when the American Families plan was introduced.

The Green Book says this. The House bill would apply the increase. But the effective date.

Potential Changes to the Capital Gains Tax Rate 2 weeks ago Jun 24 2021 The proposal would increase the maximum stated capital gain rate from 20 to 25. Which leads to the oft-asked question of when. The Green Book indicated the capital gain hike would be effective for gains required to be recognized after the date of announcement xxvi.

The effective date for this. April 27 2021 Democratic lawmakers have quietly begun discussing whether to make a proposed increase in the individual capital gains rate effective on the date the proposal. All of this is to say that the most likely outcome by far is that if any changes to the top capital gains rate are made which still seems reasonably likely they will be effective no.

We last saw a proposal to impose additional taxes on high-income individuals estates and trusts in the. In short we dont yet know the answer to this important question. No effective date for the change in capital gain tax rates for individuals was mentioned on the campaign trail or in President Bidens American Families Plan speech or fact sheet but the.

1 2022 except for the proposed increase in capital gains tax rates which would likely be effective retroactive to April. Specifically the Greenbook proposes to tax long-term capital gains and qualified dividends of taxpayers with adjusted gross income of more than 1 million at ordinary income. The effective date for most of the proposals is Jan.

The proposal would be effective for taxable years beginning after December 31 2022. The Presidents plan you may recall would make the increased capital gains rate effective after April 2021. The effective date would be retroactive to April 28 2021 the date President Biden first unveiled his proposals.

Limit the maximum 199A qualified business income deduction to 500000 in the case of a joint return 400000 for an individual return 250000 for a married individual filing. The effective date for the capital gains hike would be April 28 2021 when the American Families plan was introduced according to the Treasury Departments Greenbook a. House Democrats propose raising capital gains tax to 288 Published Mon Sep 13 2021 333 PM EDT Updated Mon Sep 13 2021 406 PM EDT Greg Iacurci GregIacurci.

The effective date for most of the proposals is Jan. President Biden has proposed a substan tial increase in the capital gains rate. Biden Budget Proposal Puts Effective Date for Capital Gains Rate Increase in Question Posted on 3 June 2021 by Mindy Kamen President Bidens tax proposal first.

Archived Tax Planning Using Private Corporations Canada Ca

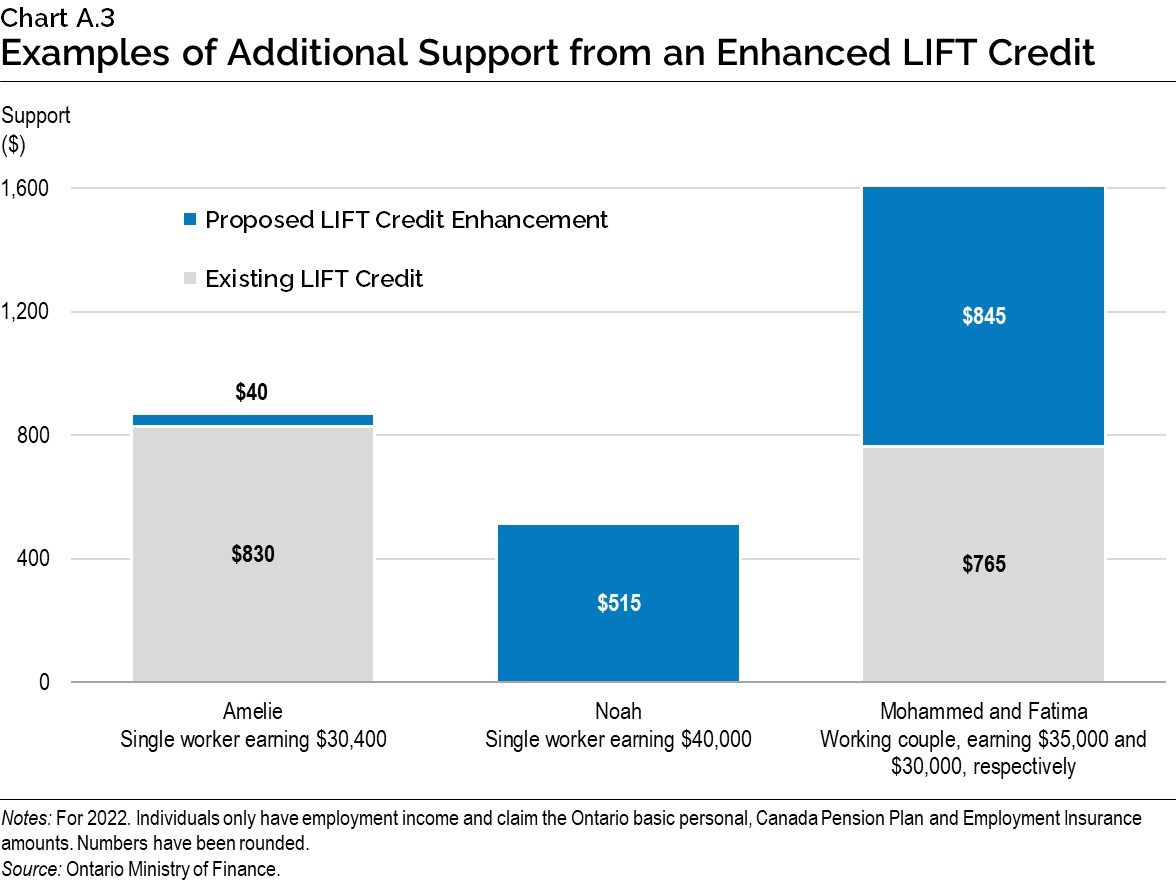

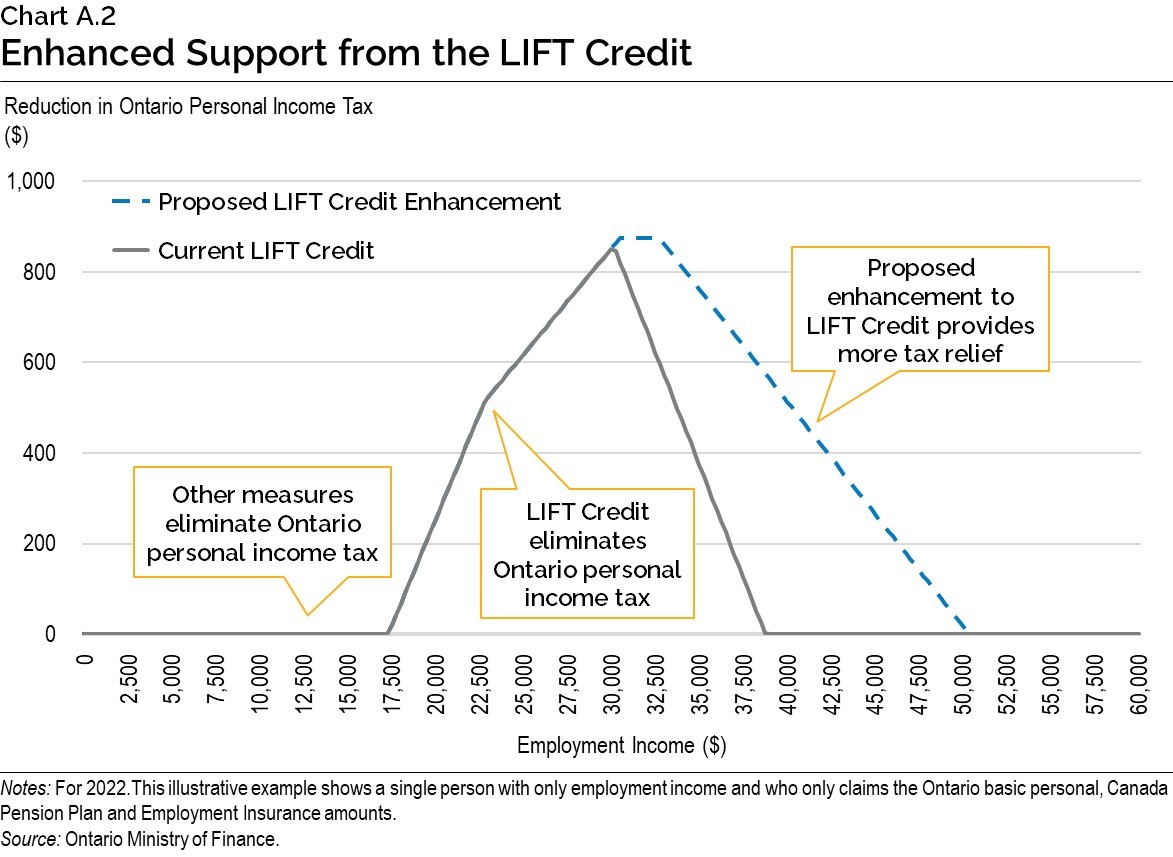

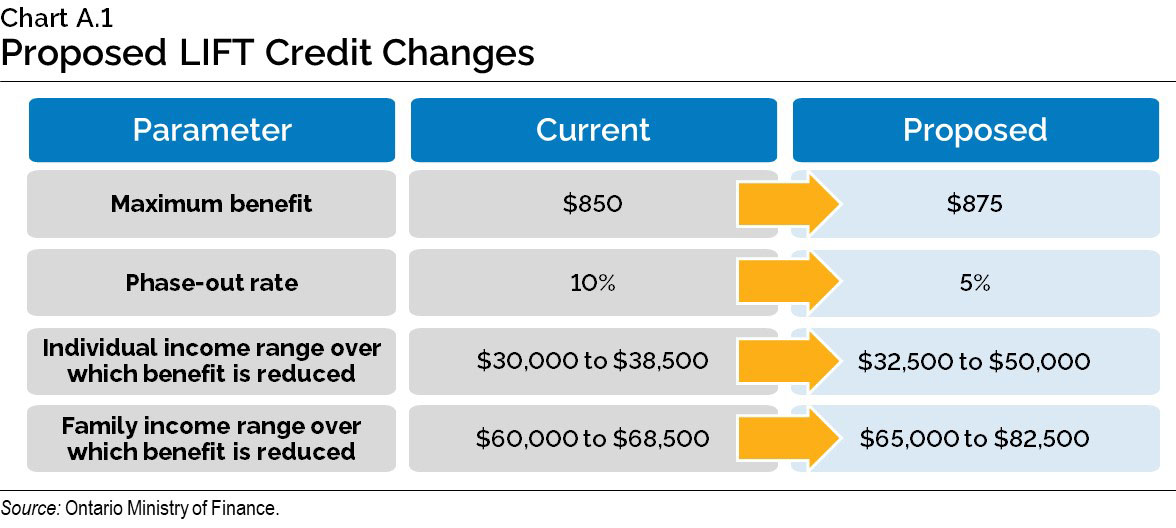

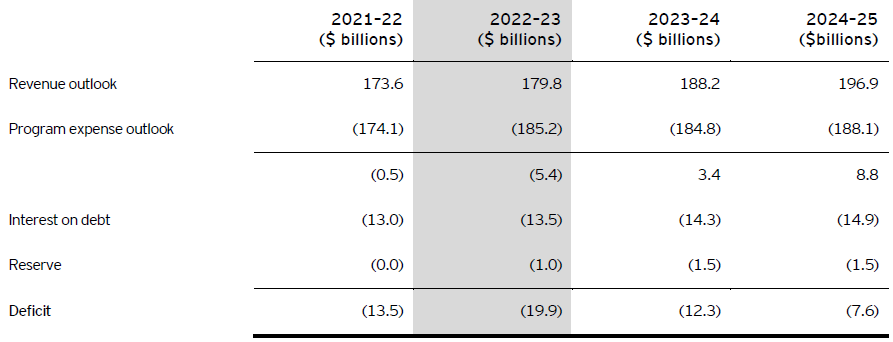

Ey Tax Alert 2022 No 27 Ontario Budget 2022 23 Ey Canada

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Canadian Tax News And Covid 19 Updates Archive Cpa Canada

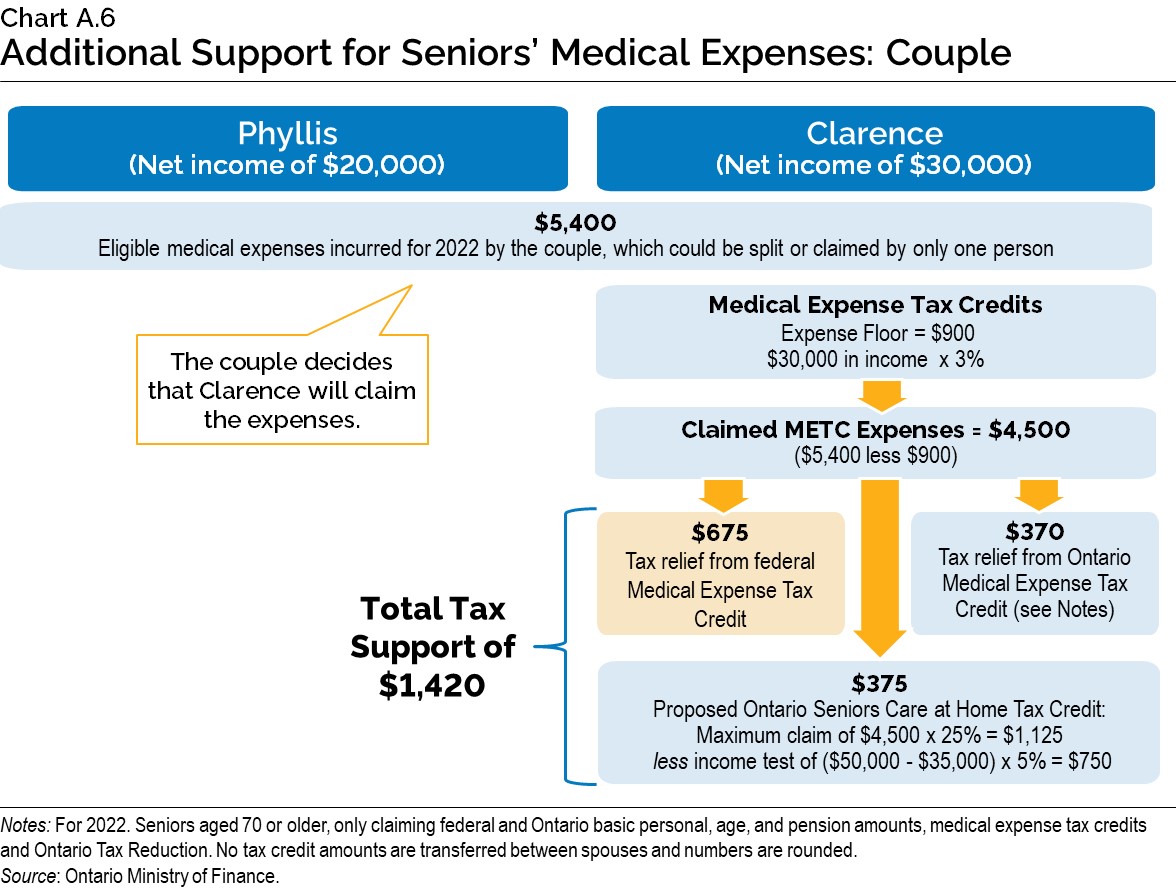

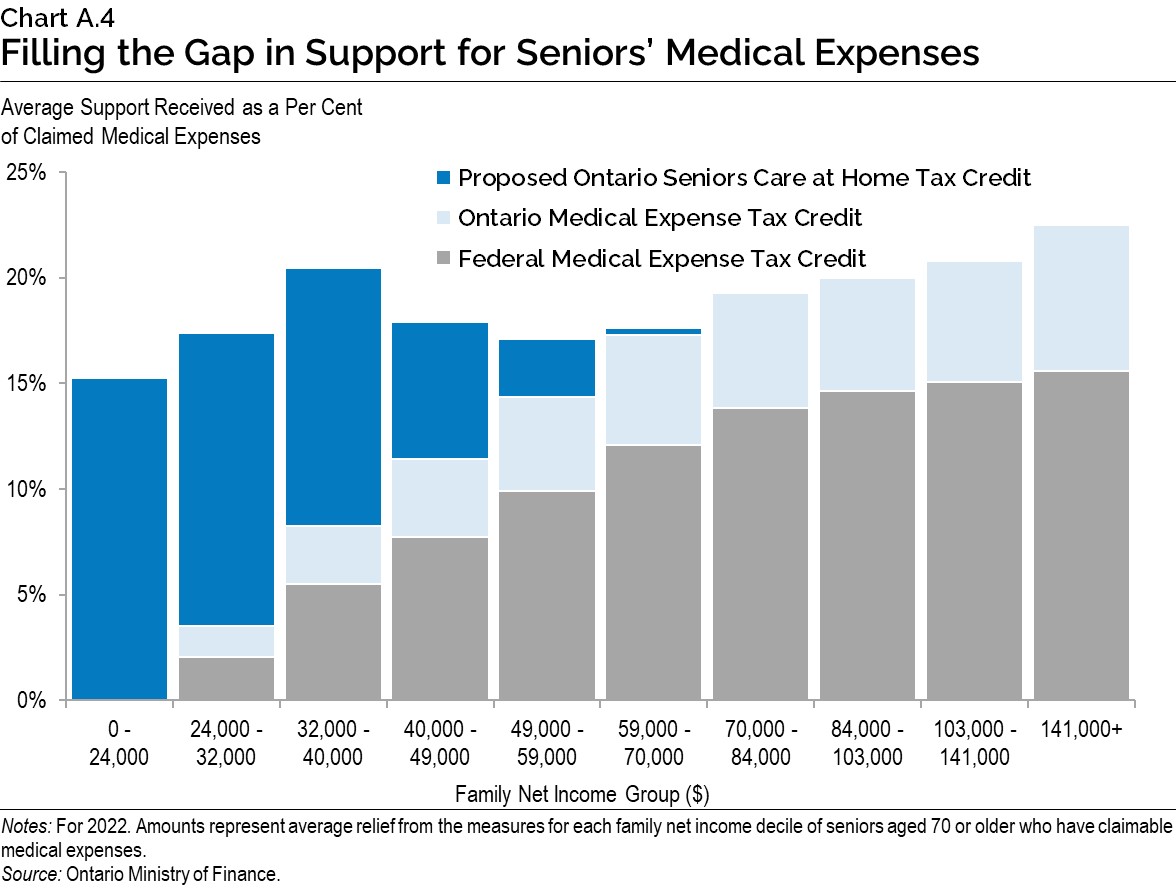

Ey Tax Alert 2022 No 27 Ontario Budget 2022 23 Ey Canada

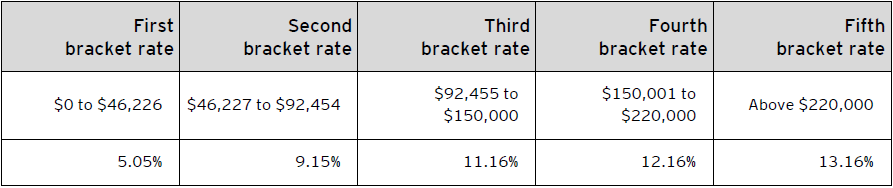

Ey Tax Alert 2022 No 27 Ontario Budget 2022 23 Ey Canada

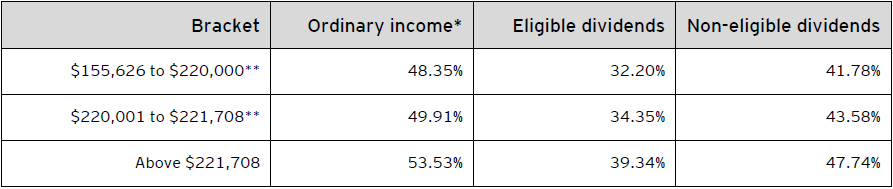

Ey Tax Alert 2022 No 27 Ontario Budget 2022 23 Ey Canada

Ey Tax Alert 2022 No 37 Finance Releases Draft Legislation For Remaining 2022 Budget Measures Ey Canada

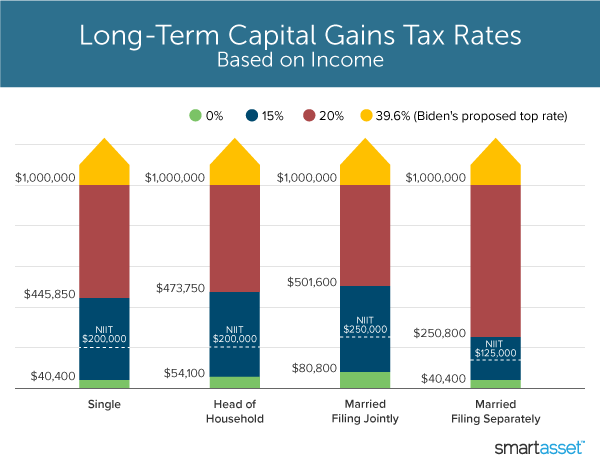

What S In Biden S Capital Gains Tax Plan Smartasset

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Income Tax Law Changes What Advisors Need To Know

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World